Margin loan on 401k

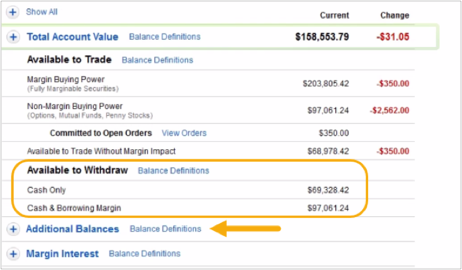

Its critical to keep your equity higher than the margin requirements. Fidelitys current base margin rate effective since 7292022 is 9325.

M1 Borrow Review Super Low Interest Margin Loans

Your 401 k plan may allow you to borrow from your account balance.

. Investments That Adjust Over Time with a Goal of Carrying You To and Through Retirement. Pay back your loan by depositing cash or selling securities at any time. Posted Nov 28 2020 1347.

See How We Can Help. 401k IRA Margin Loans. When used correctly margin loans can help you.

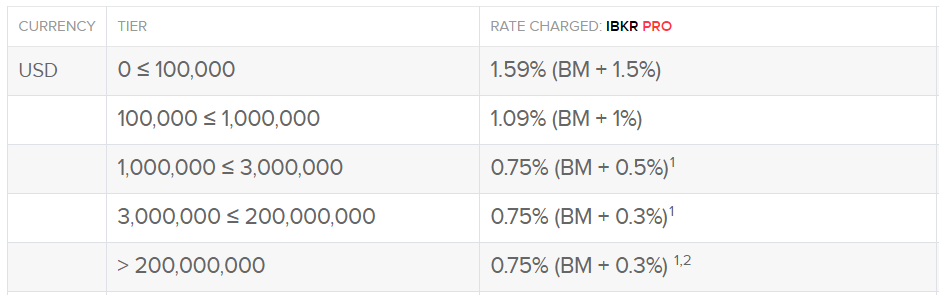

625 rate available for debit balances over 1000000. Lets say you want to buy 40000 in stock from a company but your Solo 401k only has. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee.

The problem with margin in IRAs is that the rules that give IRAs their tax advantages dont allow you to pledge the assets of your retirement account as collateral for a. Im looking into different ways to fund deals and am curious about using. Ad Built by Lawyers Powered by Pros and Dedicated to Help All Legal Professionals.

Imagine again that you used. If you dont repay the. The law allows for you to borrow up to 50 percent of the overall purchase price.

Ad Find And Apply For Top Fair Credit Loans. Ad Apply for funding if approved Pay Loan Fees Only On What You Use. Ad Age-Based Funds that Make Selection Simple.

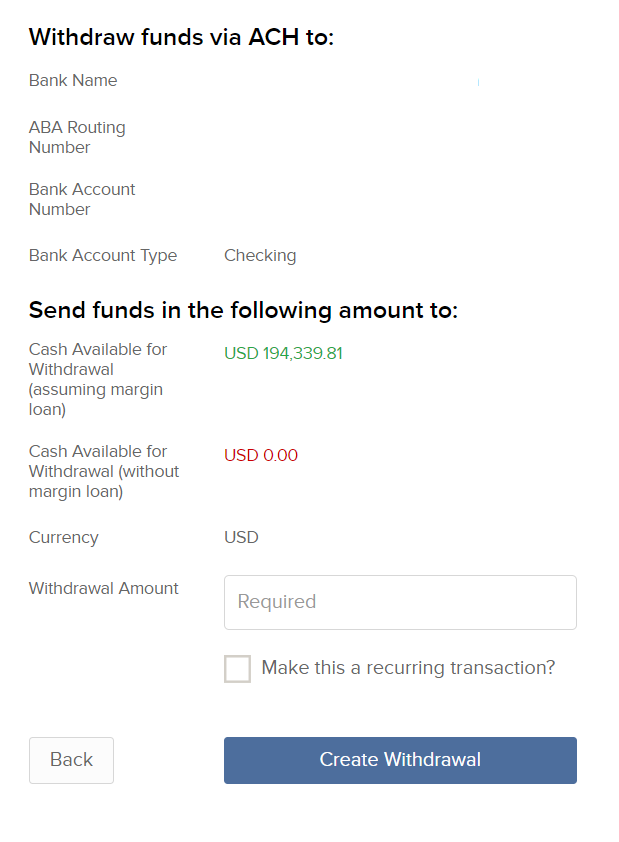

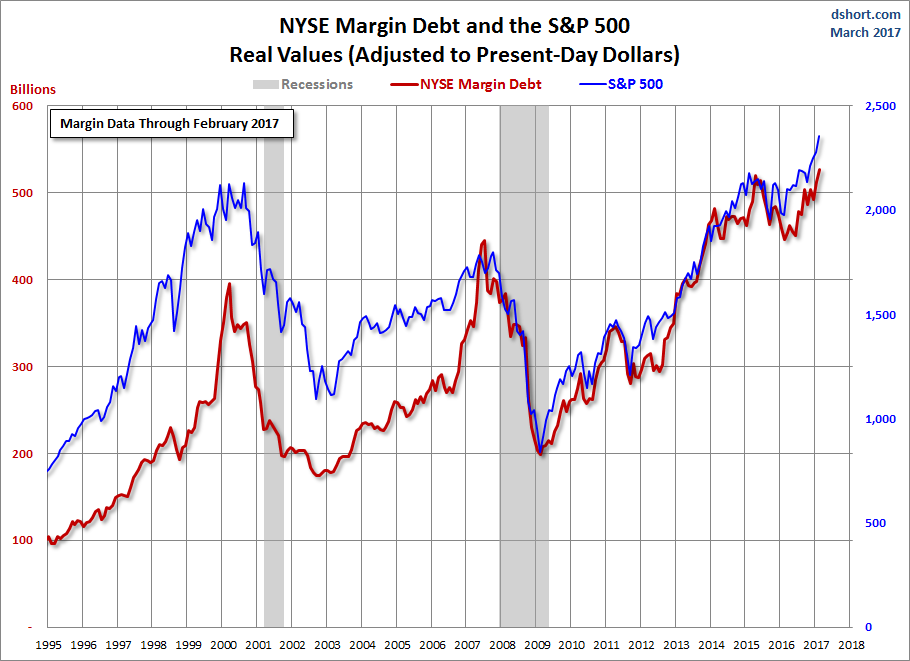

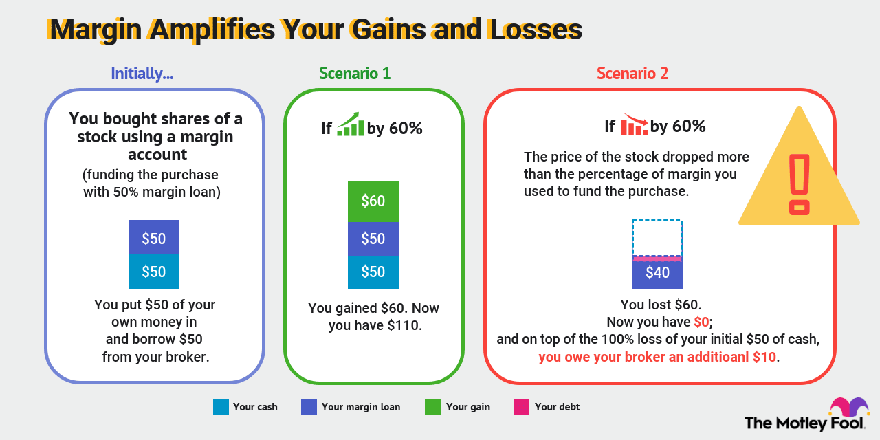

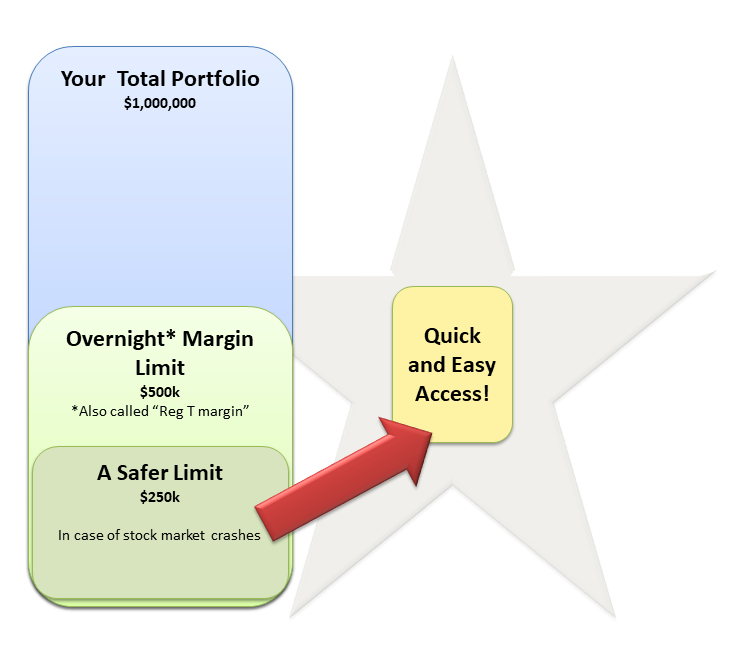

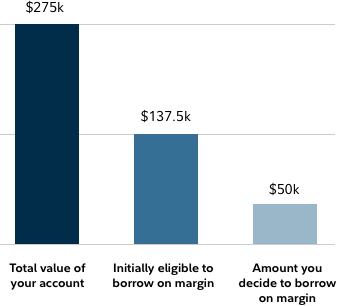

Margin is an extension of credit from a brokerage firm using your own eligible securities as collateral. Margin lending is a flexible line of credit that allows you to borrow against the securities you already hold in your brokerage account. Margin can magnify profits when your stocks are going up.

However you should consider a few things before taking a loan from your 401 k. Just as a bank can lend you money against the equity in your home your brokerage firm can lend you money against the value of eligible stocks bonds exchange. Apply for funding if approved Get Access To Funds When You Need It.

In order to short sell at Fidelity you must have a margin. Our margin rates are among the most competitive in the industryas low as 625. Margin rates as low as 283.

Rates subject to change. Schwab Margin Loans Margin lending from Schwab is a flexible line of credit that allows you. You sell and pay back 5000 plus 400 of interest 1 which leaves you with 8600.

Schwab helps you learn the benefits and risks of margin trading. So in the first case you profited 2000 on an investment of 5000 for a gain. As a rule of thumb you should control your risks by keeping margin down to no more than 15 percent of your portfolio.

The risks of margin. Most traders typically use margin as a means to purchase additional. Of that 3600 is profit.

Business 401k Plan Company Retirement Account More Account Types Open an Account. So in this case your equity would be 90 that is 450000 500000 and you would only get a margin call if your. Individual 401k SEP IRA.

However the magnifying effect works the other way as well. If the loan balance is pushed to the limit 50 percent of. Margin loans offer an opportunity to increase your investment return but any loan has risk.

A margin loan from Fidelity is interest-bearing and can be used to gain access to funds for a variety of needs that cover both investment and non-investment needs. Trusted Lenders Flexible Payments. Ad Built by Lawyers Powered by Pros and Dedicated to Help All Legal Professionals.

Solo 401k Faqs My Solo 401k Financial

3 Ways To Borrow Against Your Assets Retirement Plan Services

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

Margin Loans How It Works Fidelity

Using Leverage In Retirement Swr Series Part 49 Early Retirement Now

401 K Guide What Is A 401 K Plan And How Does It Work

Does It Matter That Margin Debt Just Hit A New All Time High Seeking Alpha

What Is Margin And Should You Invest On It

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

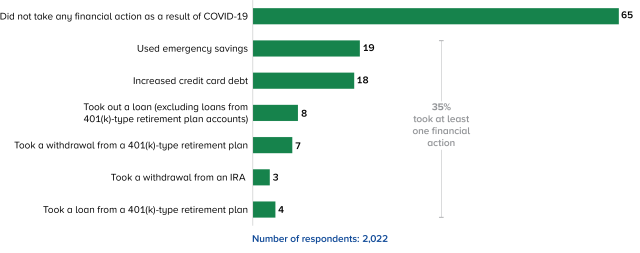

Americans Financial Response To Covid Investment Company Institute

401 K Withdrawals What Know Before Making One Ally

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

Margin Loans How It Works Fidelity